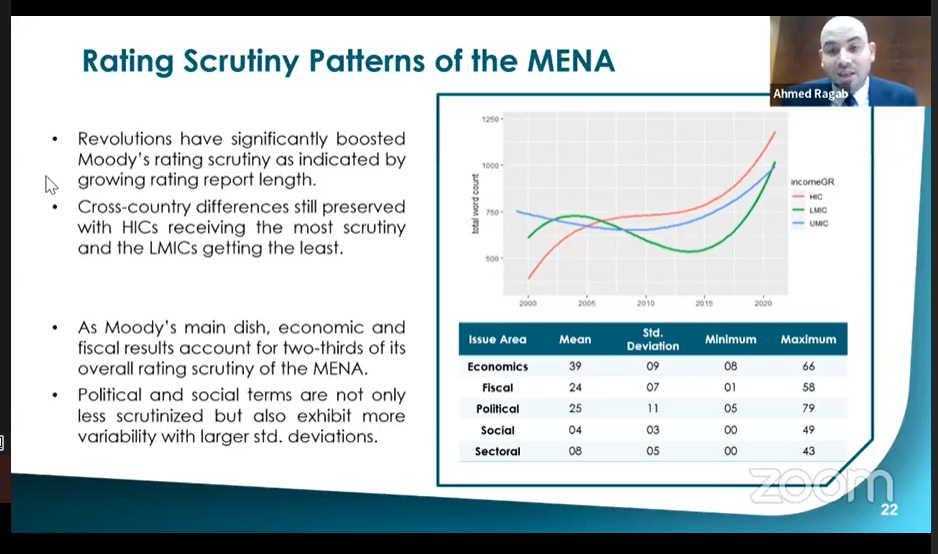

Credit rating agencies play a decisive role in determining the borrowing costs in global financial markets through the standardized ratings they produce. These agencies, despite their announced methodologies, prefer to keep their empirical evaluation receipt stealthy so that they are not obliged to justify their discretionary conduct of sovereign ratings. This webinar aimed to discuss the findings of an ECES study that evaluates the empirical scrutiny policy of Moody’s in the MENA region, by investigating the information content of 648 rating reports between 1999 and 2021.

Reading between the lines: A text-mining approach to navigate the effects of Arab revolutions on Moody’s rating scrutiny patterns in the MENA region

22-03-2022

Speakers

Ahmed Kouchouk, Hany Tawfik, Abla Abdel-Latif, and Ahmed Ragab